I have updated this blogpost with a link to the new version of my paper. The new revised paper has the title of "Pricing Assets in an Economy with Two Types of People".

-----------------------------------------

Brad DeLong kindly tweeted a link to a working paper (updated to new version May 21st 2016) I wrote last year. Matt Yglesias asks Brad to explain the paper. Let me take a stab at that.

Every graduate student of economics learns, early in her career, that markets work well. The idea that ‘markets work well’ has a well defined meaning: allocating resources by buying and selling goods in free markets does at least as well as any other way of allocating them. Let me be more precise.

A society, to an economist, is a bunch of people and a bunch of goods. A good is something that people want. For example, a ticket to see the latest Star Wars movie is a good. A bottle of Beaujolais is a good: and so is a banana. I could go on. But the basic idea here is that everyone in society has preferences over different bundles of goods. I personally would prefer a bottle of Beaujolais and a banana to a trip to the movies: but you may rank things differently.

Tuesday, December 29, 2015

Sunday, December 20, 2015

Scott Sumner and Musical Chairs

Since 2009, Scott Sumner has been a big proponent of nominal GDP targeting. He sees nominal wages as slow to adjust and he has sketched a simple model, the musical chairs model, to explain why his policy should be adopted.

I am a new convert to these arguments. That is my loss. I had assumed, incorrectly, that

Scott was proposing that central banks should simply adjust the coefficients on

their interest rate policies, so called Taylor Rules, to raise the nominal

interest rate when nominal GDP growth is above target and to lower it when nominal

GDP growth is below target.I will refer to that variant of NGDP targeting, as

growth rate targeting. An alternative, NGDP level targeting, would make these interest

rate adjustments in response to deviations of nominal GDP from a target growth

path. For an elaboration of that view, see, for example, the article by Evan Koenig, Vice President of the Dallas Fed.

Saturday, October 24, 2015

Demand Creates its Own Supply

I have been teaching basic Keynesian economics this week to my undergraduate class and I have just completed a new book manuscript with the working title of Prosperity for All, that will be coming soon to a book

store near you. I am thus highly attuned to the debate over the connection between savings and investment. That debate resurfaced with a vengeance this morning on Twitter when Noah Smith and Jo Michell, among others, engaged in a sometimes testy exchange on the role of the State in promoting investment. Since that debate is at the core of Keynesian economics, and since my class is prepping for Monday’s midterm, this seems like a great opportunity to enlighten readers of all varieties on what Jo and Noah were on about.

store near you. I am thus highly attuned to the debate over the connection between savings and investment. That debate resurfaced with a vengeance this morning on Twitter when Noah Smith and Jo Michell, among others, engaged in a sometimes testy exchange on the role of the State in promoting investment. Since that debate is at the core of Keynesian economics, and since my class is prepping for Monday’s midterm, this seems like a great opportunity to enlighten readers of all varieties on what Jo and Noah were on about.

Thursday, October 22, 2015

A Bridge Too Far?

There is much current angst on the difficult problem of how to escape a liquidity trap. Paul Krugman points out that in Japan, the ratio of debt to GDP is growing, leaving little room for a further tame fiscal expansion. He favors something more aggressive.

Tony Yates argues instead for a helicopter drop. Print money and give it to Japanese citizens. The benefit of that approach is that it does not leave the government with an increase in interest bearing debt. Simon Wren Lewis looks more closely at the technical aspects of this idea.

Tony Yates argues instead for a helicopter drop. Print money and give it to Japanese citizens. The benefit of that approach is that it does not leave the government with an increase in interest bearing debt. Simon Wren Lewis looks more closely at the technical aspects of this idea.

Sunday, October 11, 2015

Give me a One Armed Economist

I'm glad to see that Olivier Blanchard and Yanis Varoufakis have come out in favor of my plan for People's QE.

The following passage is from How the Economy Works, (HTEW) page 151.

The following passage is from How the Economy Works, (HTEW) page 151.

Economists are famous for hedging their bets. A typical response to the question of how to run fiscal policy might be: “On the one hand we should raise taxes but on the other we should balance the budget”. President Harry Truman who instituted the Council of Economic Advisors famously quipped; “give me a one-armed economist.”Here's what I said about fiscal stimulus in HTEW.

A large fiscal stimulus may or may not be an important component of a recovery plan. My own view is that there is a better alternative to fiscal policy that I explain in [How the Economy Works, Chaper 11]. But if a fiscal policy is used it should take the form of a transfer payment to every domestic resident; not an increase in government expenditure.Well ok, I didn't call it peoples QE. "Peoples QE", was coined by a speech writer for Jeremy Corbyn, the new leader of the Labour Party in the UK and its one of the less crazy parts of the Corbyn platform. Why do I believe that? Because I also believe something that may seem contradictory. Its time to get interest rates into positive territory. SOON. Quoting again from an impeccable source (HTEW page 152).

Here are my views on monetary policy. Short term interest rates should be increased as soon as feasible, because a positive interest rate is needed if a national central bank is effectively to control inflation. In future, central banks should use the interest rate for this purpose and not to prevent recessions.Why do I favor a fiscal transfer, rather than currently popular bandwagon of infrastructure expenditure? Two reasons.

- Because the work of Christina and David Romer suggests that tax multipliers (and by implication, transfer multipliers) are big.

- Because I trust markets to decide how to allocate a fiscal stimulus more than I trust the government.

So: Raising interest rates is necessary to eventually raise inflation. I'm with the "neo-Fisherians" here. But an interest rate hike must be offset by some other expansionary policy to prevent the normalization of rates from creating a new recession. Here's what I said about that in HTEW.

But if a central bank raises the domestic interest rate without independently managing confidence, the result will be a drop in the value of the national stock market and a further deterioration in the real economy. To prevent this from happening, central banks need a second instrument.So: Janet, Mark, Mario: yes: raise rates. Please. But give us QE too.

Wednesday, September 23, 2015

Beliefs are Fundamental: Whatever your Religion

A couple of weeks ago, I had the pleasure of attending a very interesting conference at the Federal Reserve Bank of Saint Louis. The topic

of the conference was the relationship between income inequality and monetary policy, but the papers, more broadly, were all trying to cope with the intellectual problem of rebuilding monetary economics to incorporate the lessons of the Great Recession.

I discussed a fascinating paper, presented by Jim Bullard, joint with Costas Azariadis, Aarti Singh and Jacek Suda (ABSS). ABSS Built a 241 period overlapping generations model in which the people who inhabit the model are permitted to trade one period nominal bonds: but nothing else. They focused on one particular equilibrium of their model and they showed that, conditional on this equilibrium, a central bank can help the economy to function efficiently. Here is a link to the paper and here is a link to my discussion.

of the conference was the relationship between income inequality and monetary policy, but the papers, more broadly, were all trying to cope with the intellectual problem of rebuilding monetary economics to incorporate the lessons of the Great Recession.

I discussed a fascinating paper, presented by Jim Bullard, joint with Costas Azariadis, Aarti Singh and Jacek Suda (ABSS). ABSS Built a 241 period overlapping generations model in which the people who inhabit the model are permitted to trade one period nominal bonds: but nothing else. They focused on one particular equilibrium of their model and they showed that, conditional on this equilibrium, a central bank can help the economy to function efficiently. Here is a link to the paper and here is a link to my discussion.

Thursday, September 17, 2015

Washington: We have a problem

John Cochrane makes the case in the WSJ that everything is back to normal. Hunky Dory, rosy tinted, don’t panic, keep-calm-and-carry-on normal. He points out that inflation is under control. We have not entered a deflationary death-spiral and unemployment is back in reasonable territory.

Here is what John learned from the Great Recession.

Here is what John learned from the Great Recession.

The [QE] experiment was huge, and the lessons are clear. The economy is stable, not subject to Keynesian “spirals” requiring constant Fed intervention. And when reserves pay the same rate as bonds, banks do not care which one they hold. So even massive bond purchases do not cause inflation. Quantitative easing is like trading a $20 bill for $10 and $5 bills. How would that make anyone spend more money?

Saturday, August 29, 2015

Not too simple: Just wrong

Simon Wren-Lewis has a nice post discussing Paul Romer’s critique of macro.

In Simon's words:

In Simon's words:

"It is hard to get academic macroeconomists trained since the 1980s to address [large scale Keynesian models] , because they have been taught that these models and techniques are fatally flawed because of the Lucas critique and identification problems."

"But DSGE models as a guide for policy are also fatally flawed because they are too simple. The unique property that DSGE models have is internal consistency."

"Take a DSGE model, and alter a few equations so that they fit the data much better, and you have what could be called a structural econometric model. It is internally inconsistent, but because it fits the data better it may be a better guide for policy."

Nope! Not too simple. Just wrong!

I disagree with Simon. NK models are not too simple. They are simply wrong. There are no ‘frictions’. There is no Calvo Fairy. There are simply persistent nominal beliefs.

Period.

I disagree with Simon. NK models are not too simple. They are simply wrong. There are no ‘frictions’. There is no Calvo Fairy. There are simply persistent nominal beliefs.

Period.

Monday, August 24, 2015

The Next Great Depression

The financial markets are in turmoil. We are dangerously

close to the next financial crisis. The

FTSE in the UK is down by 13% from its April peak. The Dow in the United States

is off by 10%

and the Hong Kong Hang Seng index, the market that is closest to the epicenter of the crisis, is

down by a whopping 21%.

Why worry? Surely this is just a market correction. Traders

in the financial markets are, after all, simply making the trades that are in

all of our best interests. I don't think so!

Are the financial markets efficient? In one sense yes. In

another sense no.

Sunday, August 23, 2015

Animal Spirits and the Two Natural Rates

In my last post I pointed out that it is not enough for monetary policy to guide the economy back to the natural rate of interest. Central banks and national treasuries must use financial policy to guide us back to the natural rate of unemployment.

But although these economies have identical fundamentals, the people in economy A are naturally optimistic. They believe that shares in their stock market are worth PA. And PA is a large number. The people in economy B are pessimists. They believe that their stock market is worth PB. And PB is a small number. Importantly, PB < PA.

Saturday, August 22, 2015

A Tale of Two Natural Rates

Narayana Kocherlakota makes the case for more public debt.

Paul Krugman and Steve Williamson agree. (I have to keep rereading that

sentence before I believe it). What is this argument all about and how does it

relate to the soul of Keynesian economics?

Let's start with a key premise in the Kocherlakota speech.

There is a theoretical concept called the ‘neutral real interest rate’ and one

of the jobs of a central bank is to get us back to that rate of interest as

quickly as possible. The ‘neutral rate’ is what Wicksell called the ‘natural rate of interest’ and I'm going to stick with Wicksell’s terminology here.

Let's start with a key premise in the Kocherlakota speech.

There is a theoretical concept called the ‘neutral real interest rate’ and one

of the jobs of a central bank is to get us back to that rate of interest as

quickly as possible. The ‘neutral rate’ is what Wicksell called the ‘natural rate of interest’ and I'm going to stick with Wicksell’s terminology here.Friday, August 14, 2015

Somebody at the PBC blinked

In a recent post I made this comment about China’s decision to intervene in its own stock market.

Chinese policy makers are now learning that lesson. The Peoples Bank of China (PBC) has allowed the Renminbi to tumble by more than 3% in the last few days. The ride may not yet be over.

What’s happening and why? It's my guess that there are investors on the margin who are pulling money out of the Chinese market and moving it into the world capital markets. Those investors are betting against the valuation that the PBC is putting on domestic assets. The outflow of funds puts downward pressure on the RMB and if the PBC were to maintain its previous parity they would be obliged to sell their holdings of dollar denominated assets to support the currency.

The PBC blinked! But that's a good thing. They’ve chosen a domestic target over an exchange rate target and to make that work, the world needs to keep buying Chinese goods.

I have advocated a policy of Treasury and Central Bank intervention to stabilize domestic asset markets. What we are seeing in the Chinese case is that this policy is inconsistent with a fixed exchange rate.

China is holding more than $1.2 trillion dollars of U.S. government debt. If the Bank were to tap those funds to stabilize the Chinese stock market it could not simultaneously maintain an exchange rate peg. If China goes that route, look out for upheaval in the foreign exchange markets.

Chinese policy makers are now learning that lesson. The Peoples Bank of China (PBC) has allowed the Renminbi to tumble by more than 3% in the last few days. The ride may not yet be over.

What’s happening and why? It's my guess that there are investors on the margin who are pulling money out of the Chinese market and moving it into the world capital markets. Those investors are betting against the valuation that the PBC is putting on domestic assets. The outflow of funds puts downward pressure on the RMB and if the PBC were to maintain its previous parity they would be obliged to sell their holdings of dollar denominated assets to support the currency.

The PBC blinked! But that's a good thing. They’ve chosen a domestic target over an exchange rate target and to make that work, the world needs to keep buying Chinese goods.

I have advocated a policy of Treasury and Central Bank intervention to stabilize domestic asset markets. What we are seeing in the Chinese case is that this policy is inconsistent with a fixed exchange rate.

Monday, July 27, 2015

Playing Chess with the Devil

I love this quote (with my amendments for economists) from the NY Times article about Terrence Tao.

The true work of the

mathematicianeconomist is not experienced until the later parts of graduate school, when the student is challenged to create knowledge in the form of a novelproofpiece of research. It is common to fill page after page with an attempt, the seasons turning, only to arrive precisely where you began, empty-handed — or to realize that a subtle flaw of logic doomed the whole enterprise from its outset. The steady state ofmathematicaleconomic research is to be completely stuck.

It is a process that Charles Fefferman of Princeton, himself a onetime math prodigy turned Fields medalist, likens to ‘‘playing chess with the devil.’’ The rules of the devil’s game are special, though: The devil is vastly superior at chess, but, Fefferman explained, you may take back as many moves as you like, and the devil may not. You play a first game, and, of course, ‘‘he crushes you.’’ So you take back moves and try something different, and he crushes you again, ‘‘in much the same way.’’ If you are sufficiently wily, you will eventually discover a move that forces the devil to shift strategy; you still lose, but — aha! — you have your first clue.That's pretty much how I feel about research. Another analogy is that research is like solving a Rubik's Cube: You're about to put the last piece in place and you find you have to go back 25 moves and start over.

Tuesday, July 21, 2015

Why the Belief Function Matters

A debate on the monetary transmission mechanism was recently reignited on the blogs with a post by Noah Smith, posts from Nick Rowe and Brad De-Long and a response to Noah from John Cochrane. This was all triggered by a set of slides prepared by Michael Woodford and Maria Garcia Schmidt for a Riksbank Conference in June 2015. A good starting point is the summary here back in 2014 by John Cochrane.

The question: If the Fed raises the interest rate will it cause more or less inflation? The answer is complex and the topics that must be dealt with in formulating that answer are at the heart of monetary economics.

In my own work, I emphasize two central points.

1. Monetary rational expectations models always have multiple equilibria.

2. The right way to deal with this is by explicitly modeling how people form beliefs using a concept that I call the belief function.

The question: If the Fed raises the interest rate will it cause more or less inflation? The answer is complex and the topics that must be dealt with in formulating that answer are at the heart of monetary economics.

In my own work, I emphasize two central points.

1. Monetary rational expectations models always have multiple equilibria.

2. The right way to deal with this is by explicitly modeling how people form beliefs using a concept that I call the belief function.

Wednesday, July 8, 2015

Fasten your seat belts; the ride is about to get choppy.

Today, the Peoples Bank of China was given the authority to purchase shares in the Chinese Stock Market. This is a bold experiment; but it is not unprecedented. In 1998, in the midst of the Asian Financial Crisis, the Hong Kong Monetary Authority engaged in a similar exercise. That intervention was large and successful and was the beginning of the end of the Asian crisis.

Today, the Peoples Bank of China was given the authority to purchase shares in the Chinese Stock Market. This is a bold experiment; but it is not unprecedented. In 1998, in the midst of the Asian Financial Crisis, the Hong Kong Monetary Authority engaged in a similar exercise. That intervention was large and successful and was the beginning of the end of the Asian crisis.Friday, July 3, 2015

Behavioural Economics is Rational After All

There are some deep and interesting issues involved in the debate over behavioural economics. Greg Hill posted a comment on my previous blog where he says:

If preferences are fixed, then we face a second question. What form do they take? For a long time, macroeconomists assumed that people maximize the discounted present value of a time and state separable von Neumann Morgenstern expected utility function. The narrow version of behavioural economics asserts that this assumption is wrong; but people are still utility maximizers.

Now, you really have to ask yourself whether the kind of rationality involved in [Thaler's idea of a nudge], where a minimal change in cost results in a significant change of behavior, is same kind of rationality Lucas and Sargent have in mind.

That led me to explain my views a little further.

The most interesting issue [with behavioural economics] is whether we should continue to accept the neoclassical assumption that preferences are fixed. Let's go with that assumption for a moment.

If preferences are fixed, then we face a second question. What form do they take? For a long time, macroeconomists assumed that people maximize the discounted present value of a time and state separable von Neumann Morgenstern expected utility function. The narrow version of behavioural economics asserts that this assumption is wrong; but people are still utility maximizers.

Sunday, June 28, 2015

The Economics of George Orwell

Diane Coyle has a nice review of Richard Thaler's new book, Misbehaving. Diane's review is, for the most part, appropriately laudatory. But she does voice a concern that I share. Here is Diane...

"Behavioural economics is now one of the most popular areas of the subject, ... but the new embrace by economists makes me uneasy. This is not just because of the well-known debate about paternalism (as discussed by Gilles St Paul in The Tyranny of Utility or Julian LeGrand and Bill New in Government Paternalism: Nanny State or helpful Friend?) It is because the sight of economists delighting in a new tool to engineer society is alarming –"I agree. Here is a quote from my review of Akerlof and Shiller's 2009 book Animal Spirits, another piece that draws on behavioural economics to engage in social engineering. Akerlof and Shiller want to replace rational choice with behavioural economics. And here is what they mean by that...

Thursday, June 18, 2015

Multiple Equilibria and Financial Crises

In May of this year, Jess Benhabib and I organized a conference at the Federal Reserve Bank of San Francisco with much help from Kevin Lansing at the Fed. Many thanks Kevin!

Friday, June 12, 2015

Running a Surplus in Normal Times is Keynesian

In a recent letter to The Guardian, a coterie of mainly English academics has criticized George Osborne's Mansion House speech in which he proposed to run a budget surplus in normal times.

According to the letter writers,

|

| Mansion House |

The chancellor’s plans, announced in his Mansion House speech, for permanent budget surpluses [my italics] are nothing more than an attempt to outmanoeuvre his opponents (Report, 10 June). They have no basis in economics. Osborne’s proposals are not fit for the complexity of a modern 21st-century economy and, as such, they risk a liquidity crisis that could also trigger banking problems, a fall in GDP, a crash, or all three.

Sunday, June 7, 2015

How to Fix the Banks: Revisited

The bankers are angry. They feel the regulations designed to prevent another meltdown are cramping their style. Their bonuses are down. I agree. Red tape is not the way to save the banking system.

The banks engaged in a freewheeling orgy of unregulated risk taking for two decades. And when the world crashed: they expected, and received, bailouts. But we don't need to bash the banks to save the system.

As a society, we do not have a stake in saving HSBC. We do not have a stake in saving Barclays, or RSBC, or Lehmann Brothers, or Bank of America. But we do have a stake in saving the banking system. Here is a link to a piece I wrote in 2009 on how to do that.

The banks engaged in a freewheeling orgy of unregulated risk taking for two decades. And when the world crashed: they expected, and received, bailouts. But we don't need to bash the banks to save the system.

As a society, we do not have a stake in saving HSBC. We do not have a stake in saving Barclays, or RSBC, or Lehmann Brothers, or Bank of America. But we do have a stake in saving the banking system. Here is a link to a piece I wrote in 2009 on how to do that.

Saturday, May 23, 2015

GDP: A Brief But Affectionate Review

For a neo-paleo-Keynesian like me, the first week of an undergraduate macroeconomics lecture is taken up with accounting: Tedious but necessary. What is GDP? How is it different from GNP? National Income? How do we measure it? Does it matter? I've always struggled with outside readings to fill this material out and make it interesting. Now I have one. Diane Coyle has written a timely and very readable little tome about her love affair with national income accounting. It's very short, and you will be able to gobble it down in an afternoon. I did, while whiling away a few hours on a flight.

Tuesday, May 19, 2015

Thought for the Day: Animal Spirits as a New Fundamental

In IS-LM models there is always something in the background shifting the IS curve. What is it?

In my view that 'something' is Keynes' animal spirits that we should add to our models as a new fundamental.

In my work, I close my models by adding an equation that I call a 'belief function'. The belief function is an effective way of operationalizing the Old Keynesian assumption of ‘animal spirits’. It is a forecasting rule that explains how people use current information to predict the future. That rule replaces the classical assumption that the quantity of labor demanded is always equal to the quantity of labor supplied.Here is a link to the blog I wrote on that topic last year.

Tuesday, May 12, 2015

Multiple Equilibria and Financial Crises

Models of sunspots and multiple equilibria were developed in the 1980s as an alternative to the dominant Real Business Cycle agenda. For the last couple of decades, these models have taken a backstage role as explanations of the macroeconomy. Now they are back with a vengeance.

On Thursday and Friday of this week, Jess Benhabib and I are running a conference at the San Francisco Fed that showcases new research on multiple equilibria and financial crises. The papers at this conference trace their roots to an agenda on sunspots, developed at the University of Pennsylvania in the 1980s.

On Thursday and Friday of this week, Jess Benhabib and I are running a conference at the San Francisco Fed that showcases new research on multiple equilibria and financial crises. The papers at this conference trace their roots to an agenda on sunspots, developed at the University of Pennsylvania in the 1980s.

The sunspot agenda began with the seminal paper by David Cass and Karl Shell, Do Sunspots Matter?, the pathbreaking paper on Self-Fulfilling Prophecies by Costas Azariadis and a paper by myself and Michael Woodford in which we developed techniques that form the basis for dynamic models of indeterminacy that are now widely used to understand monetary policy regimes.

Another important landmark was the 1994 conference at NYU, published in the Journal of Economic Theory as a symposium on Growth Fluctuations and Sunspots. Here is a link to a survey paper that explains the history of the sunspot agenda and its connection to endogenous business cycles.

I'm looking forward to the dinner talk on Thursday night by Karl Shell and I'm also looking forward to seeing the tremendous range of papers that are moving this agenda forwards in new and exciting directions. Here is a link to the conference papers.

On Thursday and Friday of this week, Jess Benhabib and I are running a conference at the San Francisco Fed that showcases new research on multiple equilibria and financial crises. The papers at this conference trace their roots to an agenda on sunspots, developed at the University of Pennsylvania in the 1980s.

On Thursday and Friday of this week, Jess Benhabib and I are running a conference at the San Francisco Fed that showcases new research on multiple equilibria and financial crises. The papers at this conference trace their roots to an agenda on sunspots, developed at the University of Pennsylvania in the 1980s.The sunspot agenda began with the seminal paper by David Cass and Karl Shell, Do Sunspots Matter?, the pathbreaking paper on Self-Fulfilling Prophecies by Costas Azariadis and a paper by myself and Michael Woodford in which we developed techniques that form the basis for dynamic models of indeterminacy that are now widely used to understand monetary policy regimes.

Another important landmark was the 1994 conference at NYU, published in the Journal of Economic Theory as a symposium on Growth Fluctuations and Sunspots. Here is a link to a survey paper that explains the history of the sunspot agenda and its connection to endogenous business cycles.

I'm looking forward to the dinner talk on Thursday night by Karl Shell and I'm also looking forward to seeing the tremendous range of papers that are moving this agenda forwards in new and exciting directions. Here is a link to the conference papers.

Sunday, April 26, 2015

The Unit Root of the Matter: Is it Demand or Supply?

John Cochrane responds to my piece on why there is no evidence that the economy is self-correcting with an excellent blog post on unit roots. John's post raises two issues. The first is descriptive statistics. What is a parsimonious way to describe the time series properties of the unemployment rate? Here we agree. Unemployment is the sum of a persistent component and a transitory component.

The second is economics. How should we interpret the permanent component? I claim that the permanent component is caused by shifts from one equilibrium to another and that each of these equilibria is associated with a different permanent unemployment rate. I’ll call that the “demand side theory”. (More on the data here and here and my perspective on the theory here and here).

The second is economics. How should we interpret the permanent component? I claim that the permanent component is caused by shifts from one equilibrium to another and that each of these equilibria is associated with a different permanent unemployment rate. I’ll call that the “demand side theory”. (More on the data here and here and my perspective on the theory here and here).

The second is economics. How should we interpret the permanent component? I claim that the permanent component is caused by shifts from one equilibrium to another and that each of these equilibria is associated with a different permanent unemployment rate. I’ll call that the “demand side theory”. (More on the data here and here and my perspective on the theory here and here).

The second is economics. How should we interpret the permanent component? I claim that the permanent component is caused by shifts from one equilibrium to another and that each of these equilibria is associated with a different permanent unemployment rate. I’ll call that the “demand side theory”. (More on the data here and here and my perspective on the theory here and here).

Modern macroeconomics interprets the permanent component as shifts in the natural rate of unemployment. I’ll call that the “supply side theory”. That theory is widely accepted and, in my view, wrong. As I predicted in the Financial Times back in 2009, "the next [great economic idea] to fall will be the natural rate hypothesis".

Friday, April 24, 2015

Beyond 1950's Economic Theory: Nonlinearity, Multiple Equilibria and Sticky Prices

David Glasner has a very nice post on Price Stickiness and Economics with great comments from Rajiv Sethi, Richard Lipsey and Kevin Donoghue among others. David reacts to a post from Noah Smith: this is all classic stuff

Here is David

While I am not hostile to the idea of price stickiness — one of the most popular posts I have written being an attempt to provide a rationale for the stylized (though controversial) fact that wages are stickier than other input, and most output, prices — it does seem to me that there is something ad hoc and superficial about the idea of price stickiness and about many explanations, including those offered by Ball and Mankiw, for price stickiness. I think that the negative reactions that price stickiness elicits from a lot of economists — and not only from Lucas and Williamson — reflect a feeling that price stickiness is not well grounded in any economic theory.

Thursday, April 16, 2015

There is No Evidence that the Economy is Self-Correcting (Very Wonkish)

David Andolfatto asks in a twitter exchange for evidence that deviations of GDP from trend are non-stationary. Here is the raw data. Figure 1 is the residual from a regression of the log of real GDP on a constant and a time trend for quarterly US data from 1955q1 through 2014q4. I will refer to this series as "X".

Monday, April 13, 2015

New Solutions to Old Problems

There was an interesting exchange over the last couple of days between two of my favorite bloggers; Frances Coppola, aka Femina Spectabilis, and Brad DeLong, aka Distinguitur Oeconomicarum. Frances delivered a talk at my alma mater, Manchester University, on the need to use non-linear models and to recognize the importance of multiple equilibria. Brava! Brad Delong, over at Equitable Growth, takes umbrage at Frances’ charge and rushes to the defense of his former teacher, Olivier Blanchard, aka Nobilis Vir.

Here is Frances at full tilt

Here is Frances at full tilt

… some of the most influential people in macroeconomics have spent their lives developing theories and models that have been shown to be at best inadequate and at worst dangerously wrong. Olivier Blanchard’s call for policymakers to set policy in such a way that linear models will still work should be seen for what it is – the desperate cry of an aging economist who discovers that the foundations upon which he has built his career are made of sand. He is far from alone.

Sunday, March 8, 2015

Yes David: Unemployment is Sometimes Involuntary

My pal David Andolfatto doesn't like it when I say that some unemployment is involuntary. Here is my response:

The idea of involuntary unemployment was introduced by Keynes in the General Theory. But you already knew that. It is defined as a situation where (in modern language) the ratio of the marginal disutility of work to the marginal utility of consumption is not equal to the real wage. That seems a pretty accurate description of the equilibrium outcome of labor search models.

The idea of involuntary unemployment was introduced by Keynes in the General Theory. But you already knew that. It is defined as a situation where (in modern language) the ratio of the marginal disutility of work to the marginal utility of consumption is not equal to the real wage. That seems a pretty accurate description of the equilibrium outcome of labor search models.

David

I am happy with the way you characterize my beliefs in the first paragraph of your blog. Unemployment is clearly not Pareto optimal. Everything you say after that is at best misleading and at worst dismissive of everything we (at least some of us) learned from Keynes.

The idea of involuntary unemployment was introduced by Keynes in the General Theory. But you already knew that. It is defined as a situation where (in modern language) the ratio of the marginal disutility of work to the marginal utility of consumption is not equal to the real wage. That seems a pretty accurate description of the equilibrium outcome of labor search models.

The idea of involuntary unemployment was introduced by Keynes in the General Theory. But you already knew that. It is defined as a situation where (in modern language) the ratio of the marginal disutility of work to the marginal utility of consumption is not equal to the real wage. That seems a pretty accurate description of the equilibrium outcome of labor search models.Saturday, March 7, 2015

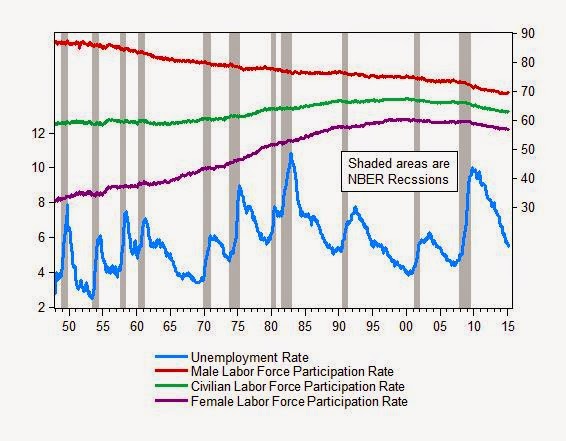

Labor Force Participation is Secular: Unemployment is Cyclical!

Updated data at the request of Andrew Sentence on participation and unemployment in the U.S.

Business cycles are about unemployment; not about changes in the participation rate.

|

| (c) Roger E. A. Farmer March 2015 |

See my twitter posts today on this topic.

If people choose to look for a job; that's their business. If people can't find a job; that's our collective business as a society.

Participation is a voluntary choice. Unemployment is not.

The idea that unemployment is voluntary is classical nonsense.

Anybody want to explain to me why they think labor force participation is a cyclical phenomenon?

Participation is not cyclical! Unemployment is!

The secular trend in participation dwarfs the cyclical movement. That's an important fact!Follow me on twitter @farmerrf

Sunday, February 15, 2015

Sam and Janet go to College

My reading list on the overlapping generations model has already generated some questions. Rather than respond in the comment section to each question individually, I will answer these questions in a new post. Here goes.

In a comment on my previous blog Brian Romanchuck has a “good grounding in mathematics” and he “understands the [overlapping generations] models.” He is my ideal reader. Brian raises a number of points that may be shared by others with a similar background. If you also have a good grounding in mathematics and you think you understand the models: this post is for you.

Saturday, February 14, 2015

The Great Blog Debate about Debt: A Reading List

I applaud everyone who has weighed in on the Great Blog debate about debt (Simon, Bob, me, and others too numerous to link. All of the issues that have been raised on Nick's blog were the topic of frontier research in economics journals in the 1950s -- 1970s. Nick has links to earlier posts here.

The paper that started all of this (at least in the English speaking world) was by Paul Samuelson. "An exact consumption-loan model of interest with or without the social contrivance of money", Journal of Political Economy 1958, Vol 66 No. 6. The French lay claim to an earlier version by Maurice Allais, but that's another story.

Samuelson's paper was a revelation to economists because it provided an example where markets don't work. In Samuelson's example, there is an equilibrium, (people optimize taking prices as given and all markets clear) that can be improved upon by a government institution. Samuelson's paper is a good starting point for those who would like to read more about this.

Samuelson's paper was a revelation to economists because it provided an example where markets don't work. In Samuelson's example, there is an equilibrium, (people optimize taking prices as given and all markets clear) that can be improved upon by a government institution. Samuelson's paper is a good starting point for those who would like to read more about this.

Monday, February 9, 2015

Sam and Janet Learn about Debt

In a recent post on the (non)-importance of debt buildup worldwide, Antonio Fatas makes the point that debt is not necessarily a problem. While I agree with that statement: a great deal hinges on the qualification “not necessarily”.

Paul Krugman goes further than Antonio. According to Paul debt is “money that we owe to ourselves”. That is at best misleading and at worst; false. Money is money we owe to ourselves. Debt is money that some of us owe to others.

Paul Krugman goes further than Antonio. According to Paul debt is “money that we owe to ourselves”. That is at best misleading and at worst; false. Money is money we owe to ourselves. Debt is money that some of us owe to others.

Saturday, February 7, 2015

Lessons from the Great Galactic Depression

A long time ago, in a galaxy far far away, there were two planets orbiting a star, not unlike our own sun. The inhabitants of these planets share a common ancestry but, over the years, they have developed somewhat different temperaments.

The names of these planets are difficult to pronounce in English, but we will call them Nordus and Sudus. The name of their star is Sol.

Nordus, being further away from Sol, has a colder climate than Sudus and its inhabitants are known to be frugal and patient. The Sudusians, in contrast, live for the moment. Using the language of economics, earth people would say that the Sudusians have a higher rate of time preference.

The names of these planets are difficult to pronounce in English, but we will call them Nordus and Sudus. The name of their star is Sol.

Nordus, being further away from Sol, has a colder climate than Sudus and its inhabitants are known to be frugal and patient. The Sudusians, in contrast, live for the moment. Using the language of economics, earth people would say that the Sudusians have a higher rate of time preference.

Wednesday, January 21, 2015

Why the ECB Should Take More Risks

Mrs. Merkel and Mr. Schäuble are worried. The ECB is planning to buy the sovereign debt of its member states and Mr. Schäuble doesn't trust his southern European partners. He thinks that Portuguese, Spanish and Italian debt is risky and he knows that Greek debt is.

Bankers are supposed to be boring. And central bankers are supposed to be boring in spades. What would happen if the Fed were to bet the farm, buying shares in an internet start-up that subsequently goes bust? The public purse would be on the hook for the loss. At least, that’s the theory. That theory is wrong.

Bankers are supposed to be boring. And central bankers are supposed to be boring in spades. What would happen if the Fed were to bet the farm, buying shares in an internet start-up that subsequently goes bust? The public purse would be on the hook for the loss. At least, that’s the theory. That theory is wrong.

The central banking business plan is a money-spinner beyond a venture capitalist’s wildest dream. Buy an asset, any asset, and pay for it by issuing little pieces of colored paper. Collect the interest payments and dividends from the assets and use them to pay for your house, your car and a holiday in Spain. If you happen to be the central bank of a sovereign state, pay the interest and dividends to the treasury to help reduce the tax bill of your citizens.

Bankers are supposed to be boring. And central bankers are supposed to be boring in spades. What would happen if the Fed were to bet the farm, buying shares in an internet start-up that subsequently goes bust? The public purse would be on the hook for the loss. At least, that’s the theory. That theory is wrong.

Bankers are supposed to be boring. And central bankers are supposed to be boring in spades. What would happen if the Fed were to bet the farm, buying shares in an internet start-up that subsequently goes bust? The public purse would be on the hook for the loss. At least, that’s the theory. That theory is wrong.The central banking business plan is a money-spinner beyond a venture capitalist’s wildest dream. Buy an asset, any asset, and pay for it by issuing little pieces of colored paper. Collect the interest payments and dividends from the assets and use them to pay for your house, your car and a holiday in Spain. If you happen to be the central bank of a sovereign state, pay the interest and dividends to the treasury to help reduce the tax bill of your citizens.

Does it matter which assets you buy? Conventional wisdom says yes. A central bank should buy safe assets, typically promises issued by its own national government that will never fall in value. The Fed buys T-bills on the private market. The Treasury pays the interest and principal to the Fed, and the Fed turns around and pays them straight back to the Treasury. The point of all of this is to keep enough of the little pieces of colored paper passing from one person to another to “oil the wheels of trade”.

Tuesday, January 13, 2015

Financial crises as global sunspots

I have just written a new working paper, 'Global Sunspots and Asset Prices in a Monetary Model', that is available on the NBER website here. The paper is a continuation of research on financial markets that I began in 2002, (2002a, 2002b) and it provides intellectual ammunition to support a proposition that I put before the UK parliament in April of 2012. We must develop a new institution that is designed to counter financial market volatility.

My paper explains three asset pricing puzzles that are difficult to reconcile with the now standard representative agent approach to macroeconomics. First, asset prices are volatile and persistent and price dividend ratios are predictable. Second, long lived risky assets earn 5% more on average than short term government debt. And third, the volatility of asset prices changes through time. I argue that all of these puzzles are caused by the simple fact that we cannot buy insurance over the state of the world we are born into.

My paper explains three asset pricing puzzles that are difficult to reconcile with the now standard representative agent approach to macroeconomics. First, asset prices are volatile and persistent and price dividend ratios are predictable. Second, long lived risky assets earn 5% more on average than short term government debt. And third, the volatility of asset prices changes through time. I argue that all of these puzzles are caused by the simple fact that we cannot buy insurance over the state of the world we are born into.Thursday, January 1, 2015

Secular stagnation: a neo-paleo-Keynesian perspective

In a recent piece on his blog, David Beckworth has taken another swing at the secular stagnation hypothesis. Secular stagnation is a term coined by Alvin Hansen in a 1938 article in which he claimed that public expenditure might be required to maintain full employment.

Here is Alvin, as quoted by David...

"The business cycle was par excellence the problem of the nineteenth century. But the main problem of our times, and particularly in the United States, is the problem of full employment. ... This is the essence of secular stagnation— sick recoveries which die in their infancy and depressions which feed on themselves and leave a hard and seemingly immovable core of unemployment."Hansen is writing in 1938, before Keynesian economics had been forever altered by Samuelson's bastardization of Keynes' key idea: that high involuntary unemployment is an equilibrium that can persist for decades.

Subscribe to:

Posts (Atom)